Project Enterprise is a New York City based microfinance nonprofit whose mission is to support and develop entrepreneurs and small businesses in the under-resourced communities of New York City. By providing microloans, business development services and networking opportunities, Project Enterprise helps entrepreneurs increase their standard of living, create jobs for their communities, and build financial assets.

History

Project Enterprise (PE) was started in 1996 by Nick and Debra Schatzki. At inception PE was the only provider of micro business loans in New York City that did not require prior business experience, credit history or collateral to provide market-rate financing for small businesses. PE has been a certified Community Development Financial Institution (CDFI) since 1998, which is a special designation by the US Treasury that identifies organizations that are effective at linking under-resourced communities with sources of capital.

In 2006, PE was recognized for its work with entrepreneurs by The Association of Enterprise Opportunity (a consortium of organizations that provide loans and/or business training to micro entrepreneurs in the United States). The recognition came as a result of Project Enterprise's Access to Markets Initiative. PE is proud to provide small loans that serve the diverse needs of our entrepreneurs. We have loaned more than $2 million to low-income entrepreneurs in New York who have used their funds to purchase supplies and equipment, develop websites, obtain licensing, and develop business cards and brochures. PE also provide members opportunities to connect through networking events, and training workshops.

PE works with minority and women entrepreneurs whose lack of assets and formal records makes them ineligible for traditional forms of business financing. Many of these entrepreneurs lack start-up capital and cannot save money fast enough to acquire the amount needed to finance a small business. They do not qualify for loans from banks because they lack assets to offer as collateral and may have bad credit histories or no credit history. Prior to coming to Project Enterprise, only 9% of entrepreneurs had received a loan from another financial institution.

Project Enterprise works with entrepreneurs regardless of their prior business experience or current business status and is the only lender in New York City that does not require credit history, guarantors or collateral to provide financing. Upon intake, 55% of entrepreneurs who join (PE) are just starting their businesses and have had no sales yet. Another 12% of entrepreneurs have been operating their business for less than 6 months and 33% have been in business for more than 6 months.

Impactful Lending

Project Enterprise (PE) offers a portfolio of loan products for entrepreneurs at various stages of businesses development. Loans are disbursed without the requirement of collateral, co-signer, or a specific credit score.

Loan distribution requires participation in one of three programs-- Peer Classic, Fast Track and Direct.

Peer Classic Loan Program- Peer-approved loans for starting a business The Peer Classic Loan Program breaks down barriers for entrepreneurs who have a great business idea but lack a credit history or collateral to secure funding from a traditional bank. This program is ideal for entrepreneurs who have been in business for a year or less. Initial loans range from $500-$1500. This first-step loan is often used to finance business expenses that range from copywriting to increasing product inventory. Once a positive repayment relationship has been established with (PE), loans can gradually increase to $12,000. Participants in the Peer Classic Loan Program are also given the opportunities to receive technical assistance, pro bono legal service, business counselling, networking opportunities and credit union referrals.

Fast Track Loan Program-Peer-approved loans for business expansion The Fast Track Loan Program is designed for entrepreneurs who have formally been in business for a year or longer. This program offers is ideal for entrepreneurs who want to move their existing businesses beyond the start-up phase. Initial loans go up to $3,000. Subsequent borrowing can increase to $12,000 based on business performance and repayment. Participants in the Fast Track Loan Program are also given the opportunities to receive technical assistance, pro bono legal service, business counselling, networking opportunities and credit union referrals.

Direct Loans Program-Larger loans for business expansion The Direct Loan Program is geared to entrepreneurs with three or more years of business operations. Loans range in size from $5,000 to $12,000. Direct Loans are characterized by flexible loan terms. Loan evaluations are conducted by a loan committee, and follow-up visits by a member of the Project Enterprise staff. Entrepreneurs are encouraged to remain connected to the Project Enterprise community and take advantage of the full portfolio of partnerships and services available.

Building Connections

Membership - Becoming a member of (PE) allows entrepreneurs to capitalize on a variety of partnerships with other business resources around New York City. Member services include pro bono legal assistance and access to ongoing business trainings.

Peer Support - Integral to PE's program is the peer support entrepreneurs receive throughout their participation. In both the Peer Lending and Fast Track programs, peer entrepreneurs review and approve all loans that are disbursed. Additionally, peer groups assist in loan application packaging and presentations. Peer group members also act as a support system for entrepreneurs who may run into difficulty with their business or their loan. Business spotlights, site visits by members to other businesses, cooperative advertising, sharing marketing and vending opportunities all help create mini chambers of commerce at every Center meeting.

Business Training - Entrepreneurs in all programs have access to PE's business training programs to improve their financial management skills. Fast Track and Peer Lending Program members all receive initial training on basic bookkeeping, cash flow management and revenue projections. Project Enterprise offers quarterly workshops on issues including marketing and financial management. In addition, PE also hosts the Entrepreneurial Assistance Program, a ten-week training program designed to help participants complete their written business plans.

Networking Opportunities -PE hosts networking events that provide an opportunity for our members from all programs and neighborhoods to build their business network and participate in educational workshops. Past networking events have featured prominent speakers with expertise ranging from garnering media attention and personal finance to hiring staff and developing a marketing plan.

Access to Markets - To help our entrepreneurs improve their competitiveness, PE has developed a strategy to connect our members with the larger marketplace. As part of this initiative, PE hosts a Holiday Bazaar, offers industry-specific Affinity Groups for networking, helps entrepreneurs and small businesses navigate the certification process to become a certified Minority and Women Owned Business and offers discounted vending opportunities across New York City. Leadership Development - Entrepreneurs in PE have many opportunities to exercise and develop their leadership skills. They can serve as peer facilitators, trainers for new entrepreneurs, guest speakers on their subject expertise, and outreach ambassadors for the organization. Leadership workshops provide information on best practices and further tools for growth.

Are You Looking for Products

Here some products related to "Project Enterprise".

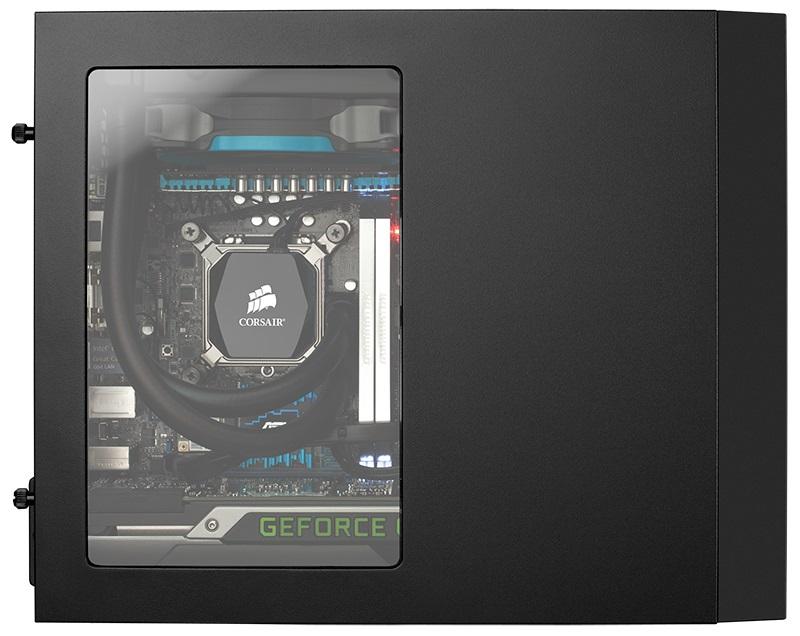

Corsair Obsidian 250D Min..

Wilson Electronics DB Pro..

The Designful Company: Ho..

Thinking, Fast and Slow: ..

Get these at Amazon.com* amzn.to is official short URL for Amazon.com, provided by Bitly

Source of the article : here

EmoticonEmoticon